Tech manufacturing theatre is the greatest show in town, but it could get serious

Intel shareholders are, most likely, rarely pleased to hear the company’s name on the morning news bulletin. The last couple of years has been a nightmare for anyone who owns a piece of Intel, starting with the admission that the company missed the GPU (and, therefore, artificial intelligence) boom, followed by costly restructuring plans to not only get back its lead in chip design but also become the world’s third party silicon manufacturer of choice. Given the sudden sacking of a chief executive, followed by mass layoffs as part of what looks increasingly like a volte-face, investors today could be forgiven for not tuning in to the business news at all.

If they did tune in, though, this morning’s news was perhaps a little worse than usual: we awoke on Friday to hear that US president Donald Trump had slapped down Intel specifically, complaining that its chief executive holds investments in outfits run by the Chinese military.

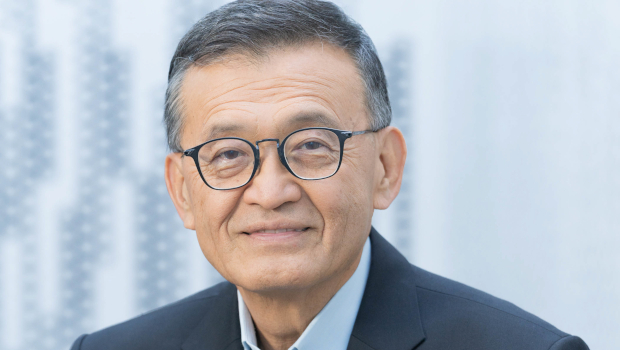

Posting on his Twitter clone Truth Social, Trump wrote: “Intel Chief Executive Lip-Bu Tan is highly CONFLICTED and must resign, immediately. There is no other solution to this problem.” Predictably, shares dropped.

The growing US-China chip war, or at least cold war, is not news, of course, but singling out a chief executive is an extreme measure (though many of Trump’s statements, including social media posts, seem to have a habit of fading to black after posting).

It is particularly interesting given that Trump, like Biden before him, talks a lot about bringing manufacturing back to the US. Not only is Intel planning to expand its domestic chip manufacturing it is, with Texas Instruments and Micron, one of the largest manufacturers of semiconductors of any kind that is headquartered in the US.

As of this week, Trump is planning a a tariff of approximately 100%, on chips and semiconductors made abroad.

Already aware of which way the wind is blowing, Taiwan’s TSMC and South Korea’s Samsung are also investing in US production (as is Micron), but neither is a US company. Keeping Intel on side would seem to make sense, then, given Trump‘s stated desire to see manufacturing grow in the United States.

Cupertino stays on side

Apple, meanwhile, has promised to build stuff at home – at precisely the same time it has moved iPhone production to India, a process that started in earnest in 2022. Apple can sidestep US tariffs on China, then, as it plans to produce most US-bound iPhones in India – not to be confused with Indiana.

At a ceremony at the White House this week, Apple boss Tim Cook (whom Trump once called Tim Apple) presented Trump with a glass and gold plaque and, more importantly, the gift of having the president announce that the company would make a further $100 million investment in US manufacturing. An Apple press release said Cook promises this included working with 10 companies to “produce components” that will be used globally by the company.

This sum is on top of $500 billion announced previously. No small sum, then, but the numbers still don’t quite add up. Estimates suggest that a US-produced iPhone would cost between $1,500 and $3,500. So, is Apple really going to make things in the US?

Parts, yes – indeed, the company already sources some materials in the US, including glass, and says it will increase its domestic production of rare earth magnets. However, the $500 billion also includes a number of things that sound rather tangential to its main business, such as an “advanced manufacturing fund”, a “manufacturing academy”, data centres, and building servers in Texas.

What is clear, however, is that Cook and Co. have realised that a flashy announcement is all that is needed to win the president’s graces. For now.

Trump this week said companies that were sincere would be given time to build domestic manufacturing capacity, but if they failed to do so, tariffs would be slapped on their imports.

“Even though you’re building and you’re not producing yet in terms of the big numbers of jobs and all of the things that you’re building. If you’re building, there will be no charge,” he said, later adding: “If for some reason you say you’re building and you don’t build, then we go back and we add it up. It accumulates and we charge you at a later date. You have to pay and that’s a guarantee.”

Consequently, Apple, and others who follow suit, have managed to carve out a temporary exception from tariffs, but they will, at some unspecified point, have to demonstrate that they have developed significant production capacity. Will they? We’ll see. Intel might, though.

Subscribers 0

Fans 0

Followers 0

Followers