The European Commission has concluded that Ireland granted undue tax benefits to Apple which amounted to illegal state aid, because it allowed the company to pay substantially less tax than other businesses.

The Commission has said that Ireland must now recover the illegal aid, which it estimates could be up to €13 billion.

“Member States cannot give tax benefits to selected companies – this is illegal under EU state aid rules,” said Commissioner Margrethe Vestager (pictured), who is in charge of competition policy. “The Commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years. In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1% on its European profits in 2003 down to 0.005% in 2014.”

A Commission statement said two tax rulings issued by Ireland to Apple “have substantially and artificially lowered the tax paid by Apple in Ireland since 1991”.

Endorsement

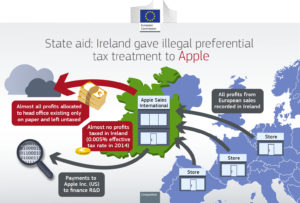

The rulings endorsed a way to establish the taxable profits for two Irish incorporated companies of the Apple group, Apple Sales International and Apple Operations Europe, said the statement, which “did not correspond to economic reality: almost all sales profits recorded by the two companies were internally attributed to a ‘head office’”.

The Commission said its assessment showed that these ‘head offices’ existed only on paper and could not have generated such profits. These profits allocated to the ‘head offices’ were not subject to tax in any country under specific provisions of the Irish tax law, which are no longer in force, it said.

“As a result of the allocation method endorsed in the tax rulings, Apple only paid an effective corporate tax rate that declined from 1% in 2003 to 0.005% in 2014 on the profits of Apple Sales International,” said the Commission statement.

Selective tax treatment

According to the statement, the selective tax treatment of Apple in Ireland is illegal under EU state aid rules, because it confers a significant advantage over other businesses that are subject to the same national taxation rules. The Commission said it can order recovery of illegal state aid for a 10-year period preceding the Commission’s first request for information, which occurred in 2013.

The statement said Ireland must now recover the unpaid taxes in Ireland from Apple for the years 2003 to 2014, of up to €13 billion, plus interest.

(Image: European Commission)

The Commissions findings were that Apple Sales International was responsible for buying Apple products from equipment manufacturers around the world, to sell on within Europe, as well as in the Middle East, Africa and India. The Commission said Apple set up its sales operations in Europe in such a way that customers were contractually buying products from Apple Sales International in Ireland rather than from the outlets that actually sold the items to customers. In this way, the Commissions said, Apple recorded all sales, and the profits stemming from these sales, directly in Ireland.

The two tax rulings issued by Ireland concerned the internal allocation of these profits within Apple Sales International, rather than the wider set-up of Apple’s sales operations in Europe.

Profits split

“Specifically, they endorsed a split of the profits for tax purposes in Ireland: under the agreed method, most profits were internally allocated away from Ireland to a “head office” within Apple Sales International. This ‘head office’ was not based in any country and did not have any employees or own premises. Its activities consisted solely of occasional board meetings. Only a fraction of the profits of Apple Sales International were allocated to its Irish branch and subject to tax in Ireland. The remaining vast majority of profits were allocated to the head office, where they remained untaxed.”

The Commission concluded that only a small percentage of Apple Sales International’s profits were taxed in Ireland, and the rest were not taxed anywhere.

“In 2011, for example (according to figures released at US Senate public hearings), Apple Sales International recorded profits of $22 billion (c.a. €16 billion) but under the terms of the tax ruling only around €50 million were considered taxable in Ireland, leaving €15.95 billion of profits untaxed. As a result, Apple Sales International paid less than €10 million of corporate tax in Ireland in 2011 – an effective tax rate of about 0.05% on its overall annual profits. In subsequent years, Apple Sales International’s recorded profits continued to increase but the profits considered taxable in Ireland under the terms of the tax ruling did not. Thus this effective tax rate decreased further to only 0.005% in 2014.”

Underpayment

The Commission concluded “the tax rulings issued by Ireland endorsed an artificial allocation of Apple Sales International and Apple Operations Europe’s sales profits to their “head offices”, where they were not taxed. As a result, the tax rulings enabled Apple to pay substantially less tax than other companies, which is illegal under EU state aid rules”.

However, the statement clarifies that the decision does not call into question Ireland’s general tax system or its corporate tax rate. It goes on to say that Apple’s tax structure in Europe, “and whether profits could have been recorded in the countries where the sales effectively took place, are not issues covered by EU state aid rules. If profits were recorded in other countries this could, however, affect the amount of recovery by Ireland”.

The decision is likely to be examined closely by other multinationals, particularly in the tech sector, as it may have implications for other such deals.

The Government has already said it would appeal any adverse finding, but the Commission is adamant that the proposed recovery must begin regardless.

UPDATE: Apple responds

Apple has reacted to the Commission ruling with an open letter to customers from CEO Tim Cook.

In the letter, Cook says that “Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law — the same kind of guidance available to any company doing business there. In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe.”

Cook goes on to question the ruling and the way in which it calls into question Irish and international tax practices.

“The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don’t owe them any more than we’ve already paid.”

However, central to Cook’s argument is accepted international tax practices.

“Taxes for multinational companies are complex, yet a fundamental principle is recognized around the world: A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.”

As the Commission findings are that Apple attributed the bulk of its European profits to a head office that existed only on paper, this would appear to undermine Cook’s own argument.

Cook goes on to say that the ruling could have wider implications for other companies, with potentially adverse effects for other activities.

“Beyond the obvious targeting of Apple, the most profound and harmful effect of this ruling will be on investment and job creation in Europe. Using the Commission’s theory, every company in Ireland and across Europe is suddenly at risk of being subjected to taxes under laws that never existed.”

Despite this, Cook reaffirms Apple’s commitment to Cork and Ireland.

“We are committed to Ireland and we plan to continue investing there, growing and serving our customers with the same level of passion and commitment. We firmly believe that the facts and the established legal principles upon which the EU was founded will ultimately prevail.”

TechCentral Reporters

Subscribers 0

Fans 0

Followers 0

Followers