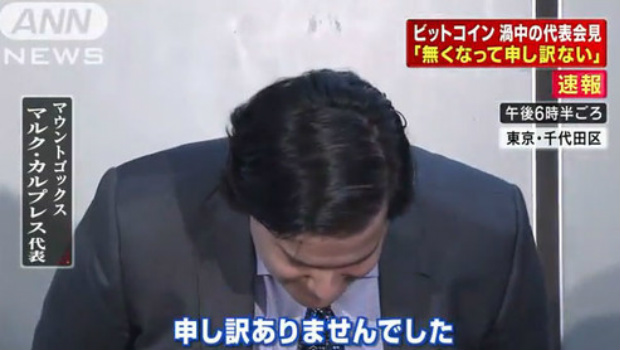

A US district court judge on Tuesday froze the US assets of Mark Karpeles, CEO of failed Bitcoin exchange Mt. Gox, and two associated companies, allowing lawyers to begin demanding documents from the three parties to investigate what they allege is a huge fraud.

Mt. Gox, once the largest Bitcoin exchange in the world, suspended trading on 25 February. Three days later, it said it had lost around 850,000 bitcoins. At the time, the bitcoins were worth around $474 million. The Tokyo-based exchange filed for bankruptcy protection in Japan shortly afterward, immediately raising the question of whether users would ever get their money back.

Tuesday’s ruling, at the US District Court for the Northern District of Illinois in Chicago, covers the CEO and Mt. Gox’s US subsidiary and Japanese parent company, Tibanne KK, but it doesn’t cover the failed Mt. Gox itself, according to Chris Dore, a partner at Edelson PC in Chicago.

Dore is representing Gregory Greene, a US citizen who filed the Chicago lawsuit against Mt. Gox on 27 February and who says he lost around $25,000 worth of bitcoins in the collapse.

The Japanese company is excluded because lawyers working for Karpeles successfully argued in a Dallas court on Monday for US bankruptcy protection for the company. The Dallas ruling didn’t include Karpeles or the two other companies because they haven’t filed for bankruptcy.

Dore said the ruling means he can immediately begin demanding documents from the three parties, a legal process called discovery. Typically, it takes several weeks or months for the discovery process to begin.

Dore said he suspects there may be ongoing fraud and that Mt. Gox’s bankruptcy efforts are an attempt to protect itself.

“Money is moving around as we speak, bitcoins are moving around accounts associated with Mt. Gox,” said Dore, referring to reports on movements of bitcoins from accounts analysts say could be associated with the failed exchange. “Something is not right so we urgently need to get to the bottom of this quickly.”

The Chicago lawsuit has been proposed as a class-action suit. If approved by the court – something that will be requested at a later date – it would allow others affected by the collapse of Mt. Gox to join Greene in the case and be considered in any award.

“I’ve been contacted by at least 300 people from around the world who could be class members, at least the US citizens among them,” Dore said.

Martyn Williams IDG News Service

@martyn_williams martyn_williams@idg.com

Subscribers 0

Fans 0

Followers 0

Followers